Beyond the Price Tag: Why Value is Your Ultimate Currency

In today's competitive landscape, your product or service isn't just a collection of features or a line item on a balance sheet. It's a promise, a solution, and a perceived benefit in the mind of your customer. Mastering Pricing Structure and Value Proposition Analysis isn't merely an exercise in financial modeling; it's the fundamental discipline that connects what you offer to what your customers truly desire and are willing to pay for. Ignore this connection, and you risk not only losing market share but fading into irrelevance. Get it right, and you unlock sustainable growth, stronger customer loyalty, and a powerful competitive edge.

This guide will demystify how these two crucial business concepts intertwine, providing a roadmap to ensure your pricing strategy doesn't just cover costs, but actively communicates and captures the true value you deliver.

At a Glance: What You'll Learn

- What a Value Proposition truly is: Its origins, purpose, and the anatomy of a compelling statement.

- The unbreakable link: How your pricing structure must reflect and reinforce your value proposition.

- The power of value-based pricing: Why pricing based on perceived customer benefits trumps cost-plus models.

- A practical, step-by-step framework: How to analyze customer needs, quantify value, assess competitors, and build a robust pricing model.

- Real-world examples: See how leading companies successfully implement value-based pricing.

- Common pitfalls to avoid: Ensure your strategy remains agile and effective.

The Core Equation: Value Proposition = Promise, Pricing Structure = Delivery

Before we dive into the mechanics of pricing, let's get crystal clear on the bedrock concept: the value proposition. It’s more than just marketing jargon; it's the very reason your business exists in the eyes of your customer.

What Exactly Is a Value Proposition? (Beyond the Buzzword)

Imagine you're trying to convince a friend to try a new coffee shop. You wouldn't just list ingredients; you'd highlight why it's better for them. Perhaps it’s their cozy ambiance (intangible benefit), the lightning-fast Wi-Fi (specific need fulfillment), or their unique cold brew that keeps you energized for hours without the jitters (differentiator and tangible benefit). That's your informal value proposition at work.

Formally, a value proposition is a concise marketing statement summarizing why a consumer should choose your particular product or service. Originating from a 1988 McKinsey & Co. research paper, it's defined as "a clear, simple statement of the benefits, both tangible and intangible." This powerful message articulates how your offering fulfills a need, why it stands out from competitors, and essentially serves as a promise from your company to a specific customer segment.

Its core purpose isn't just to sound good; it's to:

- Attract customers: Clearly state what problem you solve and why your solution is ideal.

- Maintain a competitive advantage: It’s your "economic moat," distinguishing you from alternatives.

- Convince stakeholders: From investors to employees, it clarifies your worth.

Hallmarks of an Effective Value Proposition:

An ideal value proposition is clear, concise, prominently displayed, and intuitively understood. It avoids buzzwords and directly appeals to what drives customer decision-making. Think of it as a laser beam cutting through the noise, highlighting: - Specific benefits: What positive outcomes will the customer experience?

- Customer needs addressed: How does it solve their pain points or fulfill their desires?

- Differentiation: What makes you uniquely better than the competition?

- Resonance: Does it speak directly to your target audience's deepest motivations?

Typically, a strong value proposition includes a memorable headline (the core benefit) and a subheadline (2-3 sentences expanding on that value, perhaps with examples or key features). Visuals can often seal the deal, communicating complex ideas at a glance.

The Cost of a Weak Value Proposition:

If your value proposition fails to convincingly convey unique benefits, the ripple effects can be devastating: diminished consumer interest, decreased profitability, loss of market share, difficulty attracting investment, and, ultimately, business failure. It's the foundation upon which all other marketing and sales efforts are built.

Connecting the Dots: Why Pricing Isn't Just a Number

Once you’ve honed your value proposition, the next critical step is to ensure your pricing structure doesn't undermine it, but rather reinforces and enhances it. Pricing is not merely a cost-recovery mechanism; it's a powerful communication tool. The price you set for your product or service sends a direct message about its quality, exclusivity, and, most importantly, its perceived value.

Imagine a luxury watch brand pricing its artisanal timepieces at a discount store level. The inherent value proposition of craftsmanship, prestige, and exclusivity would instantly be shattered. Conversely, a groundbreaking software solution that promises to save companies millions might struggle to gain traction if priced as if it were a commodity.

This is where value-based pricing enters the picture – an approach that aligns your price directly with the benefits customers believe they receive, aiming for higher profitability and deeper customer satisfaction.

Value-Based Pricing: Aligning Price with Perception

Forget the outdated "cost-plus" model, where you simply add a margin to your production costs. While understanding your costs is essential for profitability, it tells you nothing about what your customer truly values. Value-based pricing flips this script: it's a strategy where a product or service's price is determined by its perceived value to customers, rather than just production cost or historical prices.

This approach isn't about arbitrary inflation; it’s about aligning your revenue with the actual economic, functional, and emotional benefits your customers derive.

Benefits of a Value-Based Approach:

- Increased Profit Margins: When prices reflect true customer value, you capture a larger share of that value.

- Enhanced Customer Satisfaction and Loyalty: Customers who feel they’re getting a great deal for the benefits received are happier and more likely to stick around.

- Stronger Competitive Advantage: You differentiate on value, not just price, making it harder for competitors to undercut you.

- Improved Product Focus and Innovation: The constant need to understand and quantify customer value drives continuous improvement and innovation.

Challenges to Navigate:

While powerful, value-based pricing isn't without its hurdles: - Complexity of Assessing Value: Accurately understanding and quantifying what customers value can be difficult.

- Extensive Market Research: It requires ongoing, in-depth market research to stay attuned to customer needs and perceptions.

- Risk of Misjudgment: Incorrectly valuing your offering or misjudging customer willingness to pay can lead to lost sales or untapped revenue.

Key Components of Value-Based Pricing:

To successfully implement this strategy, you need a firm grasp of several moving parts: - Customer Perception of Value: What do your customers believe they are gaining?

- Clearly Defined Value Proposition: What specific benefits are you promising?

- Market Segmentation: Different customer groups value different things; tailor your approach.

- Competitive Analysis: How do your competitors price and communicate their value for similar (or alternative) solutions?

- Cost-Benefit Analysis (from the customer's perspective): Are the benefits worth the price?

- Customer Willingness to Pay (WTP): The maximum price a customer is ready to spend.

Building Your Pricing Structure from the Ground Up: A Step-by-Step Value Analysis

Let's break down the process of building a pricing structure anchored in value. This isn't a linear checklist; it’s an iterative journey requiring deep empathy and analytical rigor.

Step 1: Deep Dive into Customer Needs and Preferences

You can't price for value if you don't understand what value means to your customer. This initial step is foundational.

- Market Research is Your Compass: Conduct thorough surveys, in-depth interviews, and focus groups. Don't just ask what they want, ask why.

- Identify Pain Points and Aspirations: What problems keep your customers up at night? What dreams do they have? How does your product solve these problems or help achieve these dreams?

- Uncover Desired Outcomes: Customers don't buy drills; they buy holes. What specific, measurable outcomes do they hope to achieve by using your solution?

Step 2: Segmenting Your Market for Precision Value

Not all customers are created equal, and neither are their perceptions of value. A "one-size-fits-all" pricing strategy almost always leaves money on the table or alienates segments.

- Identify and Prioritize Segments: Group customers based on demographics (age, income), psychographics (values, lifestyle), buying behavior (frequency, loyalty), and — most importantly — their specific needs and value perceptions.

- Tailor Your Approach: A small business might value cost savings and ease of use, while an enterprise client might prioritize advanced features, scalability, and dedicated support. Your pricing models and communication should reflect these differences.

Step 3: Uncovering and Quantifying Your Value Drivers

This is where "value" starts to become tangible. You need to identify all the benefits your product offers and, crucially, attempt to quantify them in monetary terms.

- Tangible Benefits: These are the measurable, concrete advantages. Think cost savings (e.g., reduced operational expenses, lower energy bills), increased revenue (e.g., higher sales conversions, faster market entry), improved productivity (e.g., saved hours, optimized workflows), or enhanced efficiency.

- Intangible Benefits: These are harder to put a dollar figure on but are often powerful decision drivers. Examples include brand prestige, emotional satisfaction, peace of mind, improved decision-making, reduced risk, or enhanced company reputation.

- How to Quantify: For tangible benefits, conduct ROI calculations, A/B tests, or use customer case studies. For intangibles, surveys measuring perceived improvements or willingness to pay for specific emotional benefits can offer insights. For instance, a SaaS solution might help a company save $500/month in labor costs, reduce IT overhead by $300/month, and provide enhanced data security valued at $200/month by the client. The combined economic value is $1000/month.

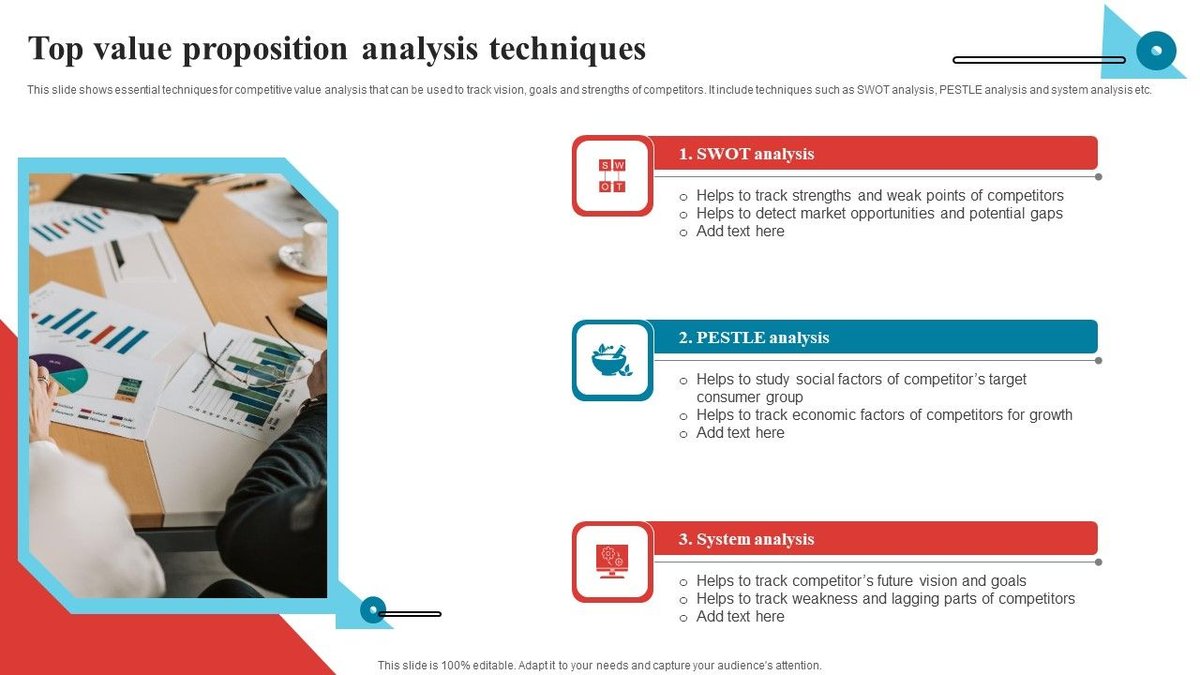

Step 4: Strategic Competitor Analysis: Knowing Your Alternatives

Your pricing isn't just about your value; it's also about your value relative to alternatives.

- Benchmark Against Competitors: Analyze their pricing strategies, product features, and how they communicate their value.

- Define the "Next Best Alternative": What would customers do if your product didn't exist? What's their current solution, and what are its costs (direct and indirect)? This forms your baseline for economic value.

- Identify Your Differentiation: Where do you truly stand out? This is where your unique value proposition comes into sharp focus, allowing you to justify a different price point.

Step 5: Decoding Willingness to Pay (WTP)

Understanding WTP is critical because it reveals the upper limit of your potential pricing. It’s what customers are actually prepared to spend.

- Pricing Research Methods:

- Conjoint Analysis: Presents customers with different feature bundles at varying prices to see what they value most.

- Van Westendorp Price Sensitivity Meter: Asks customers four questions about price (too cheap, bargain, expensive, too expensive) to identify an acceptable price range.

- Gabor-Granger Technique: Shows prices and asks customers about purchase intent at each price point.

- Beyond Stated Preference: Be wary of simply asking "What would you pay?" as customers often understate their true WTP. Use behavioral data and advanced research methods to get a more accurate picture.

Step 6: Crafting Your Pricing Model and Structure

Now, it’s time to synthesize your findings into a concrete pricing model and choose an appropriate structure.

- Economic Value Estimation (EVE or EVC): This calculates the total value your product delivers to a customer compared to their next best alternative. If your solution provides $1000/month in value compared to the alternative, you know you have room to price below $1000 but well above your costs.

- Establish a Rational Price Range: Your price should be:

- Above your costs (obviously!).

- Below the customer's willingness to pay.

- Reflective of your quantified value drivers.

- Exploring Different Pricing Structures: The structure is how you present that price.

- Tiered Pricing: Offering different packages (Basic, Pro, Enterprise) with varying features and support levels. This captures different customer segments' value perceptions (e.g., Salesforce).

- Subscription Models: Recurring revenue based on ongoing access and value (e.g., Netflix, SaaS).

- Freemium: A free basic version to hook users, with premium features requiring payment.

- Per-User/Per-Feature: Common in software, scaled by usage or access.

- Performance-Based: Fees tied to actual outcomes or results (common in consulting, advertising).

- Premium Pricing: Emphasizing exclusivity, quality, and brand prestige (e.g., Rolex, Apple).

- Value-Added Reselling: Packaging your product with services or other offerings to increase perceived value.

For example, our SaaS solution with an EVC of $1000/month. If basic competitor solutions are $50/user/month and customers are willing to pay up to $100/user/month for advanced security and support, you might price a basic plan at $80/user/month (emphasizing core productivity savings) and a premium plan at $120/user/month (highlighting advanced security, enhanced support, and deeper integration capabilities).

Step 7: Communicating Your Value Proposition Loud and Clear

Even the most perfectly calculated price will fail if customers don't understand why it's priced that way. Your pricing strategy must be supported by compelling communication.

- Justify the Price: Don't just state the price; explain the benefits that warrant it. Connect the dots between the cost and the value received.

- Educate Your Customers: Use testimonials, case studies, whitepapers, and even ROI calculators to demonstrate the tangible benefits and economic returns.

- Tell a Story: Your brand narrative and marketing messages should consistently reinforce the value you deliver, making the price feel like a fair exchange for the transformation you offer.

Step 8: The Iterative Loop: Monitor, Adjust, Innovate

The market is dynamic, and customer perceptions evolve. Your pricing strategy shouldn't be set in stone.

- Track Key Performance Indicators (KPIs): Monitor sales volume, profit margins, customer acquisition costs, churn rates, and customer lifetime value.

- Collect Ongoing Feedback: Stay connected to your customers. Are they happy with the value? Do they feel the price is fair?

- Be Prepared to Iterate: Market conditions change, new competitors emerge, and your product evolves. Regularly review your pricing structure and be ready to make data-driven adjustments. This continuous feedback loop ensures your pricing remains competitive and aligned with perceived value.

Real-World Value in Action: Illuminating Examples

Many successful companies didn't get where they are by simply undercutting the competition. They excelled by understanding and capitalizing on their unique value.

- Pharmaceuticals (e.g., Gilead Sciences' Sovaldi): This hepatitis C drug, priced at $84,000 for a 12-week course, was controversial but justified by high cure rates and the long-term savings in healthcare costs it provided compared to chronic treatment and liver transplants. The value proposition was "cure for a life-threatening disease."

- Technology/Software (e.g., Salesforce): Their CRM software is priced based on the value delivered, linked to user count and features. Basic plans offer core functionality, while enterprise tiers provide extensive customization and support, reflecting the deeper value larger organizations derive.

- Luxury Goods (e.g., Rolex watches): Rolex prices are exceptionally high, not just for the materials, but for the craftsmanship, heritage, precision engineering, and the enduring prestige and status associated with owning one. The value proposition extends beyond telling time to a statement of success and lasting quality.

- Consulting Services (e.g., McKinsey & Company): These firms set fees based on the anticipated value their strategic advice will generate for clients, whether it's significant cost savings, revenue growth, or market transformation. Their value proposition is "unparalleled expertise leading to transformative business outcomes."

- Automotive (e.g., Tesla): Tesla vehicles are priced higher than many conventional cars due to their advanced electric technology, environmental benefits, cutting-edge features (like autonomous driving capabilities), and the brand's innovation image. The value proposition includes sustainability, performance, and technological leadership.

- Healthcare Services (e.g., Mayo Clinic): Known for premium prices, Mayo Clinic justifies them through renowned expertise, integrated care, and high success rates for complex conditions. Their value is "world-class medical care with superior outcomes."

- Subscription Services (e.g., Netflix): Netflix uses tiered pricing based on features like the number of concurrent screens, streaming quality (SD, HD, 4K), and ad-free options. Customers choose the tier that aligns with their usage and perceived viewing quality needs.

- Education/Training (e.g., Harvard Business School MBA): High tuition fees are common, justified by the significant career advancement, networking opportunities, and substantial earning potential that graduates gain. The value proposition is "a transformative educational experience leading to elite career prospects."

- Consumer Electronics (e.g., Apple iPhone): Apple products command premium prices due to perceived superior design, user experience, robust ecosystem, and brand prestige. Their value proposition combines innovation, ease of use, and status.

- Fashion/Apparel (e.g., Chanel): Prices reflect brand heritage, high-quality materials, artisanal craftsmanship, and the exclusivity of their designs. The value is rooted in luxury, timeless style, and aspiration.

These examples illustrate that value-based pricing isn't limited to a specific industry. It's a universal principle for businesses that genuinely understand what they offer and how it benefits their audience. If you're pondering which investment advisory might align with your personal financial goals, you might consider how their pricing reflects their promised value. For instance, Is Motley Fool right for you? – an investment service – also hinges its value on its perceived ability to deliver superior returns and insightful market analysis.

Common Pitfalls in Pricing Structure and Value Proposition

Even with the best intentions, it's easy to stumble. Here are some common traps to avoid:

- The "Cost-Plus" Trap: Relying solely on production costs + a margin. This ignores customer perception entirely and leaves money on the table.

- Ignoring Customer Perception: Assuming you know what customers value without asking or researching. Your perception of value might differ wildly from theirs.

- Undervaluing Your Offering: Pricing too low because you lack confidence or fear competition. This erodes profitability and can signal lower quality.

- Poor Communication of Value: Having a great product and a solid pricing strategy, but failing to articulate why it's worth the price to the customer.

- Failing to Segment: Applying a single pricing strategy across diverse customer groups with different needs and willingness to pay.

- Not Monitoring and Adapting: Setting a price and never reviewing it. Markets, competitors, and customer needs are constantly changing.

- Focusing Only on Features, Not Benefits: Customers buy solutions, not just specifications. Your communication must bridge this gap.

Demystifying Pricing: Your FAQs Answered

Let's tackle some common questions and misconceptions about pricing structure and value proposition analysis.

Q: Is value-based pricing only for premium products or luxury brands?

A: Not at all! While often associated with premium offerings, value-based pricing is applicable to any product or service. The key is to identify the specific value you offer to your target customers, whether it's luxury, convenience, efficiency, reliability, or affordability for a particular segment. Even a low-cost item can be value-based if it uniquely solves a problem at that price point.

Q: How often should I review my pricing structure?

A: Ideally, you should have an ongoing monitoring process. A formal review should happen at least once a year, or more frequently if there are significant changes in the market (e.g., new competitors, economic shifts), your costs, or your product's features. Always be ready to iterate.

Q: What's the difference between a value proposition and a unique selling proposition (USP)?

A: A value proposition is a broader statement of the overall value and benefits a customer receives, addressing their needs and why they should choose you. A Unique Selling Proposition (USP) is a more specific, distinct aspect of your product or service that sets it apart from competitors. Your USP is often a key component within your broader value proposition.

Q: Can I use value-based pricing in conjunction with other pricing strategies?

A: Absolutely. Value-based pricing is an overarching philosophy that can inform various specific pricing strategies. For example, you might use a value-based approach to determine the overall price range, then implement a tiered or subscription structure to cater to different segments within that range. It's about how you derive the price, not necessarily the specific numerical structure.

Your Next Steps: Turning Insight into Impact

Mastering your pricing structure and value proposition analysis isn't a one-time project; it’s an ongoing commitment to understanding your customer, communicating your worth, and adapting to a dynamic market.

Start by auditing your current value proposition. Is it clear? Is it compelling? Does it genuinely resonate with your target audience? Then, begin the deep dive into customer research and competitive analysis. Quantify the tangible and intangible benefits you provide, and critically assess whether your current pricing model truly reflects that value.

The goal isn't just to make more money, though that's a welcome outcome. It's to build a sustainable, customer-centric business that consistently delivers on its promises and is rewarded for the genuine value it creates. By aligning your pricing structure with a powerful value proposition, you're not just selling a product; you're selling a solution, a benefit, and a desirable future for your customers.